Tailored Solution for Your Business

SMEs

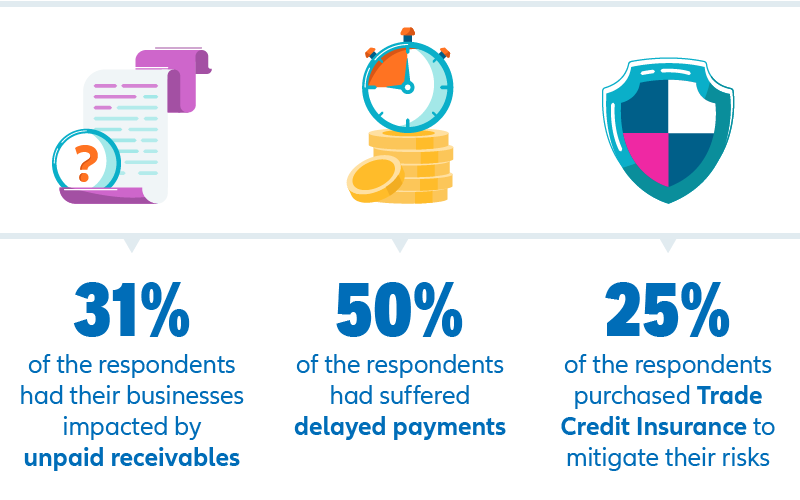

Learn how credit insurance data helps businesses to identify creditworthy customers, protect receivables, and safely grow sales.

Multinationals Companies

We build & manage robust, global insurance for credit risk & related services for you with confidence to trade in this complex environment.

Follow us